NASDAQ:AAPL – As The Market Goes, So Goes Apple Shares

NASDAQ:AAPL – As The Market Goes, So Goes Apple Shares

Some people might argue with me that Apple (NASDAQ:AAPL) stock prices are immune to fluctuations on the overall market (NASDAQ). This argument stems from the fact that Apple stock prices have recently hit all time highs, and also that Apple (Steve Jobs) has promised more amazing product releases – even beyond the iPad.

However, today will prove this assumption – that Apple stock prices are exempt from market fluctuations – false.

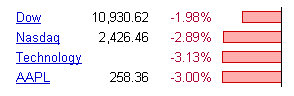

All of the major indexes are down currently – here’s where they’re at:

Notice the bottom line is Apple (AAPL) – also down 3%.

So as you can see, and for those of you who believe that Apple stock prices are immune to the market, your theory just doesn’t hold.

Upcoming Apple News

Some of the more prominent events coming up for Apple are:

- WWDC2010 (Apple’s developers conference) on June 7th

- Rumors that iPhone 4G will be announced at WWDC

- Also rumors that Apple will expand iPhone to other mobile phone carriers like Verizon.

Although the iPhone and mobile phone carrier expansion rumors are just that – rumors, it does seem logical especially since Steve Jobs has been quotes as saying that Apple has some amazing product launches coming in the near future – beyond just the iPad.

So what do you think?

Do you think that Apple stock prices are immune from overall market fluctuations?

42 replies on “NASDAQ:AAPL – As The Market Goes, So Goes Apple Shares”

pretty silly to check on a particular day's stats and 'predict' something. you could have provided supporting data from over a quarter or so to establish the pattern that you are trying to establish..

Thank you – I won't have to repeat myself…

Thank you – I won't have to repeat myself…

correlations don't prove causation.

Absolutely! Apple depends on the "Market" to sell their producst and remain profitable, therefore if the "market" goes so does Apple. Duhhh!

lol..aapl also has a beta greater than 1.5…so yeah apple is less immune to overall market fluctuations.. its not secret!

As I read these comments, I chuckle. Has anyone considered how the World market reacted today because of countries debts? The US market reacted the same. Think people!! Sheesh . . .

Apple is susceptible to hedge funds. Probably a bunch of Goldman Sachs asshole-types that love to destroy any company as long as they can make money from it. I can picture all those MF'ing white guys rubbing their hands in glee, laughing and shorting everything at the slightest downward movement. At least with Apple, tomorrow the shares will be nearly back up to where they were a few days ago. Market manipulation has become rampant and apparently nothing can be done about it. One day it's one thing good, the next day it's something bad and the next day it's something good again to drive share prices wildly up and down like a roller-coaster. There's no valid reason at all for solid stocks to be swinging like this unless somebody's trying to move them up and down.

I think Apple is more or less immune to being held down long-term unless the economy collapses again. I doubt if this is what we're seeing. It makes little sense for companies that are sucking in revenue like a vacuum to be held down. Certainly independent investors wouldn't be selling off Apple shares in unison. It has to be those hedge funds manipulating millions of shares as a way to make money. Screw those bastards.

Apple is susceptible to hedge funds. Probably a bunch of Goldman Sachs asshole-types that love to destroy any company as long as they can make money from it. I can picture all those MF'ing white guys rubbing their hands in glee, laughing and shorting everything at the slightest downward movement. At least with Apple, tomorrow the shares will be nearly back up to where they were a few days ago. Market manipulation has become rampant and apparently nothing can be done about it. One day it's one thing good, the next day it's something bad and the next day it's something good again to drive share prices wildly up and down like a roller-coaster. There's no valid reason at all for solid stocks to be swinging like this unless somebody's trying to move them up and down.

I think Apple is more or less immune to being held down long-term unless the economy collapses again. I doubt if this is what we're seeing. It makes little sense for companies that are sucking in revenue like a vacuum to be held down. Certainly independent investors wouldn't be selling off Apple shares in unison. It has to be those hedge funds manipulating millions of shares as a way to make money. Screw those bastards.

pretty silly to check on a particular day's stats and 'predict' something. you could have provided supporting data from over a quarter or so to establish the pattern that you are trying to establish..

No mention that an announcement was made today that Apple may be investigated for anit-trust laws regarding their licensing agreement with Iphone App developers? Do you think that had anything with Apple being down 3%? Were you even aware of the news? Either way, you just lost all credibility… Good luck with your next article.

No, I don't think that was responsible for the 3% decline. That news may have brought a 1% drop early on, but would have been quickly reversed. Fear was high and liquidation begun, Tech is easily liquidated. Huge mistake of many, even if they hope to get back in at an even lower price.

No, I don't think that was responsible for the 3% decline. That news may have brought a 1% drop early on, but would have been quickly reversed. Fear was high and liquidation begun, Tech is easily liquidated. Huge mistake of many, even if they hope to get back in at an even lower price.

This one arbitrailily-chosen time these two variables moved the same amount in the same direction. Ergo one of these variables is affected by the other one, and anyone who thinks otherwise is wrong.

correlations don't prove causation.

I think you should fix the English in your headline. "As the market goes, so go Apple shares."

Either one sounds awful.

Perhaps a good alternative title would be: "Apple Stock and the Market Both Fell By the Same Percentage Amount on a Random Tuesday in May, 2010, Conclusively Demonstrating that Apple and the Market Move in Lock-Step: Told You So, Morons!"

it's got a ring to it.

Get a life–stock was at $80 last March, its now over $250. That's 300% gain. You write a sucky blog.

Get a life–stock was at $80 last March, its now over $250. That's 300% gain. You write a sucky blog.

Reuters: “Regulators are considering an inquiry into whether Apple Inc violates antitrust law"… yeah that happened today… I'm sorry that somehow Apple's stock being immune from market fluctuations somehow seems to personally offend you. I couldn't care either way honestly and I'm not about to waste my time trying to prove it or disprove it but that being said I actually have a question to ponder as well, "Did the market go down today because of Apple?" lol