The Dow Jones Industrial Average (DJIA) slumped more than 1000 points as a result of the number of infected from novel coronavirus have soared high.

In addition, this is considered to be the worst drop in a single day for the past 2 years and the third-worst drop in its 124 years long history.

As the coronavirus is rapidly spreading to the countries outside of China, like Iran, Japan and Italy, it threatens to dent worldwide supply chains and economies.

The Dow Jones was more than 900 points down after Mondays selloff

The Dow Jones benchmark works by measuring the stock performance of 30 large-cap companies.

It is noted that the Dow Jones tumbled more than 900 points after numbers of deaths caused by corona had jumped to 2612.

Furthermore, United Health, American Express, Cisco, Visa, Walgreens, and Apple were all falling under 4% and were marked as worst-performers.

However, all of the 30 Dow Jones’s components performed lower while UnitedHealth Group Inc. experienced a whopping 7.8% downturn.

In addition to the Dow Jones, the other two major benchmarks, Nasdaq and S&P 500 also suffered a significant drop where each fell under 3% on the same day.

The coronavirus outbreak made companies issue warnings regarding their business targets

The coronavirus, officially named COVID-19, has led companies to issue warnings about their business and expected earnings and revenues.

Furthermore, experts are calculating the impact that this outspread will have on economies while the most affected will be the supply chain and transportation industry.

So it is to be expected that we shall experience rapid cancellation of flights and other planned travel arrangements.

Microsoft already declared that its revenue guidelines for its key segments won’t be met.

Meanwhile, Apple announced that its iPhone world supply will be temporarily constrained and as a result, this tech giant won’t meet its second-quarter revenue guidance and its shares were down 6%.

What is to be expected in the Down Jones aftermath

When it comes to similar events in the past, there was an eventual rebound in economies followed by huge surge like the one with coronavirus.

Monday’s downturn has wiped out this year’s gains for the Dow (now -2.02%) and the S&P 500 (now -0.15%).

This Monday’s downward trend has expunged this year’s gains for the Dow Jones and the S&P 500, which are now -2.02% and -0.15% respectively.

However, Dow Jones Market Data shows that after a huge carnages to stocks, they tend to get a rebound after a decline of at least 2%.

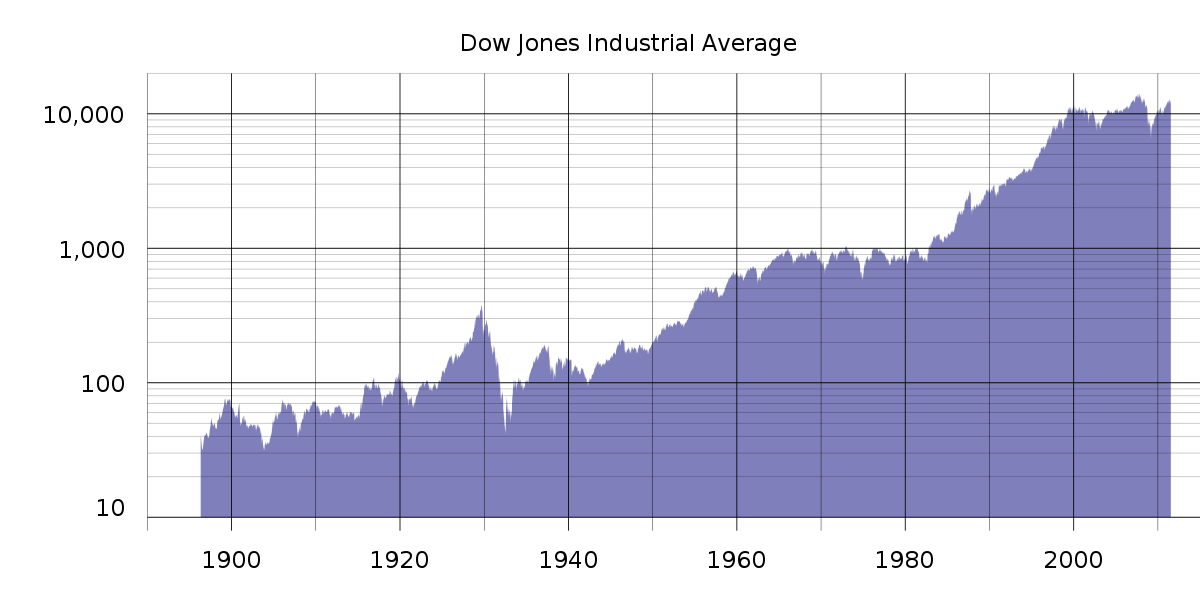

Moreover, the Dow Jones index has a history where it recovered significantly in the period after the downfall.

In that light, Dow Jones records show that after a huge surge in the past, the Dow fell by -0.19% the day after. However, 1 week after the surge it increased by 2.07%, and the next month by 2.93% followed by the next year increase by 12.5.

Anyhow, the past evidence of how did the market perform is of no guarantee of what will happen in the future. If coronavirus turns to a pandemic it could lead to a potentially matchless results for market and economy.