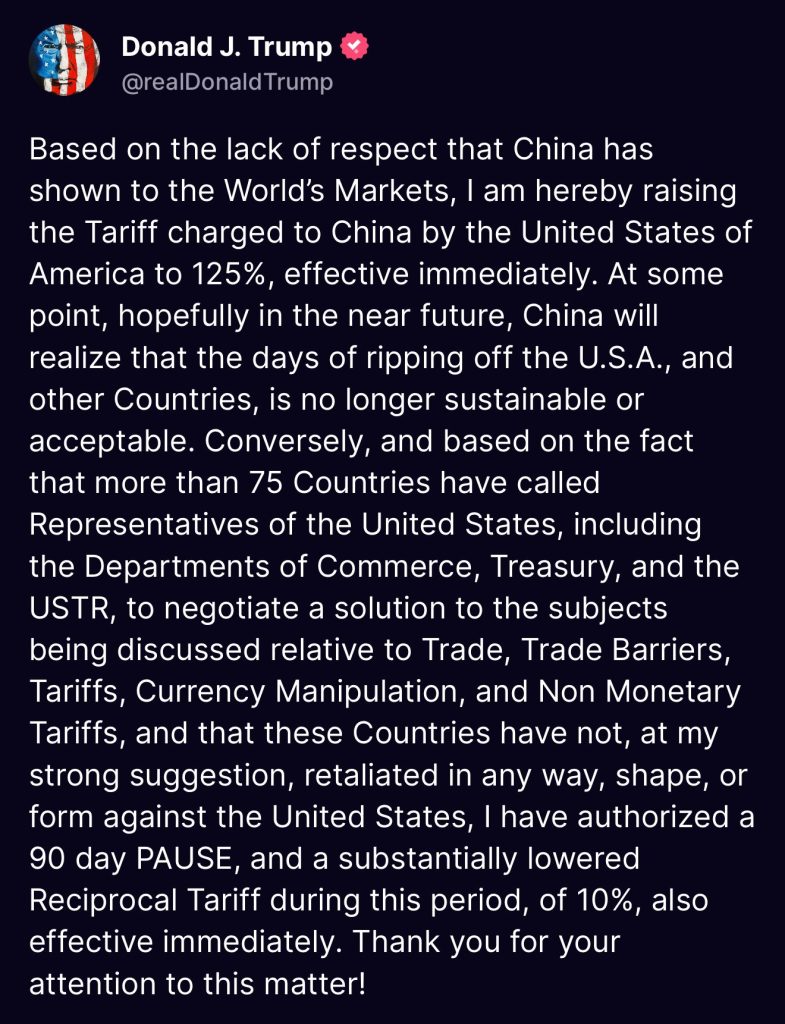

Former President Donald Trump has announced a new 125% tariff on all Chinese imports, effective immediately. This follows a previous 104% rate and represents a sharp escalation in the U.S.-China trade policy. Trump also authorized a 90-day pause with a reduced 10% reciprocal tariff during this window for other trading nations cooperating diplomatically.

This development answers the trending question: “What does 125% tariff mean?” and is likely to have an even greater impact on consumer prices, manufacturing, and global trade tensions.

If you’re asking “what does 125% tariff mean”, you’re not alone — it’s one of the most searched phrases right now. In short, it means that importers are now required to pay 125% of the product’s value in taxes when bringing goods from China into the U.S. A $100 product would now cost $225 before retail markup, placing significant pressure on small businesses and consumers.

📊 Updated U.S. Tariff Rates on Chinese Imports – April 2025

| Product Category | Previous Tariff Rate | New Tariff Rate |

|---|---|---|

| General Imports | 104% | 125% |

| Electronics | 104% | 125% |

| Textiles | 104% | 125% |

| Machinery | 104% | 125% |

💡 What Does a 125% Tariff Mean for the U.S. Economy?

- Sharp Rise in Consumer Prices: Most imported products from China will more than double in price, affecting electronics, clothing, and appliances.

- More Strain on Small Businesses: Those dependent on Chinese suppliers may struggle with profit margins or need to raise prices drastically.

- Incentive for Domestic Manufacturing: U.S.-based production may become more attractive, though startup and equipment costs remain a barrier.

- Growth in Resale & Recycling Markets: As prices rise, consumers may look to buy used goods, resell, or delay replacing items — potentially reducing waste.

📘 Tariff Basics: A Quick Overview

- What Are Tariffs? Government-imposed taxes on imports, usually to protect domestic industries or penalize unfair trade practices.

- How Do They Work? Importers pay the tariff when goods enter the country, often passing costs to consumers.

- Who Is Affected? Everyone in the supply chain — from manufacturers and retailers to end consumers — especially when tariffs spike like this.